Six Notes on Trends in the Travel Market of the Future

A Joint Post by Petra Hedorfer (GNTB) and Matthias Schultze (GCB)

© DZT, Farideh Diehl / GCB, Michael Pasternack

© DZT, Farideh Diehl / GCB, Michael Pasternack

When global tourism came to a virtual standstill following the outbreak of the coronavirus pandemic, the end to business travel was equally abrupt. The result was a complete reset of the positions gained in the international market. This also means that the slates have been wiped clean for the restart. The 2022/23 Meeting- & EventBarometer (MEBa), the OMR Hamburg and the IMEX Frankfurt provide key indicators for the current situation and the trends in the market.

Petra Hedorfer and Matthias Schultze have formulated six notes to analyse how Germany has mastered the initial recovery phase, which developments and criteria will be important for the future of business travel, and how Germany can benefit from future changes in the market.

1. The international business travel market is experiencing strong growth after three years of crisis. Inbound tourism to Germany has recovered exceptionally well and could even extend its leading position in the future.

Let’s start by looking at the key data. The international business travel market is gradually making up for the marked decline caused by the coronavirus pandemic. However, the recovery rate in 2022 did not reach the level of other sectors such as holidays and other private trips.

| 2019 | 2022 | Recovery Rate | |

| Holidays | 40.7 million | 30.0 million | 73.7% |

| Business Travel | 16.1 million | 11.0 million | 68.3% |

| Other Private Travel | 13.1 million | 10.7 million | 81.7% |

Source: IPK 2019–2023, WTM.

According to IPK International, the number of business trips from Europe to Germany more than doubled in 2022 compared to 2021 (up 122 per cent), but still fell around 30 per cent short of the record figure in 2019 (2019 absolute: 13.3 million business trips from Europe, 2022: 9.2 million).

Of the more than eleven million business trips to Germany in 2022, 84 per cent originated in European source markets and 16 per cent from overseas, with numbers from the latter increasing more than threefold year on year. This is particularly impressive considering that China only eased its travel restrictions in March 2023, and that this major economy was essentially unable to contribute to the volume of international business trips to Germany in 2022.

Germany further consolidated its position as Europe’s top business travel destination during the initial restart.

Maintaining this strong position in the future will require a robust analysis of the factors that make Germany an attractive business travel destination, and comprehensive trend monitoring in terms of technological possibilities, communication patterns, market opportunities and acceptance of innovations within society.

Germany’s excellent global image is without doubt one of the biggest assets. Indeed, the Anholt-Ipsos Nation Brands Index (NBI) ranks Germany as the number one nation brand. Of the six sub-indices that make up the NBI Hexagon, ‘exports’ and ‘people’ are particularly relevant to the business travel market. Business travel is driven by commercial relationships and networks that are strengthened through face-to-face interaction, and these are two categories in which Germany also performs exceptionally well.

Another significant factor is Germany’s expertise in the key areas of business and economics and science and research. According to MEBa, more than three-quarters of event planners surveyed choose the venue for their events based on the strength of the relevant sector locally.

What’s more, business travellers from abroad praise the consistently high standard of quality and choice. Respondents in the Quality Monitor survey of the German tourism industry gave Germany an overall rating of 1.95 – on a scale of 1 (delighted) to 6 (disappointed) – for the survey period from May 2015 to October 2022.

At the same time, we know that developments in the world economies are becoming less predictable and that the perception of a brand can change due to external factors. To safeguard the future of any business travel destination, it is essential to establish an attractive environment for business travellers and thus further build on the brand profile.

2. The business travel market is very important to Germany both as a destination and in terms of its wider economy.

The business travel segment is very important to Germany’s inbound tourism industry. Some 20 per cent of trips to Germany from abroad are made for business reasons, while the average across Europe is a mere 11 per cent.

In addition, business travellers make a disproportionately high contribution to value creation. Foreign business travellers spent €131.00 per night in Germany in 2022, including travel to the country, considerably more than holidaymakers (€107.70) and people making other private trips (€80.50).

This is important because value creation was one of the areas that was hit badly by the pandemic. Not only did the number of travellers fall, but the per-head spend also dropped – from €127.50 per day of travel in 2019 to €94.40 in 2021.

According to IPK International, revenue generated by European business travellers to Germany fell from €10.5 billion in 2019 to €3.8 billion in 2021, the second year of the pandemic, before recovering to €7.0 billion in 2022. This drop and partial recovery is mirrored along the entire tourism value chain. Business travellers, trade fairs and conferences increase the room occupancy rate in urban hotels outside of the main holiday season, making them a countercyclical factor that will help to stabilise the wider recovery in this area.

And according to the 2022/2023 MEBa, 88 per cent of providers in the events market reported an average 77 per cent increase in revenue compared to the previous year.

Another key economic factor, especially when it comes to promotable travel, is investment, for example in upgrades to conference technology and in infrastructure such as event venues and conference centres, which are the basis of an attractive and competitive offering. For these investments to pay off, it is essential to generate sufficient levels of demand. The pandemic has hit many service providers hard in this respect.

3. The business travel market is undergoing long-term, fundamental change. This change has been accelerated by the pandemic. Is a rollback looming?

The business travel market is undergoing a progressive transformation. During the last decade, from the end of the global financial crisis to the outbreak of the coronavirus pandemic, the number of business trips to Germany steadily grew from 12 million in 2010 to 16 million in 2019. During the same period, the proportion of traditional business trips fell from 53 per cent to 44 per cent, while promotable business trips grew in terms of both absolute figures and market share.

Since the pandemic, the question is about shifts in demand in individual sectors. Is the slower rate of recovery in traditional business trips (63 per cent) a sign of a permanent shift to the virtual realm, for example in the shape of video conferences? Or is it more that the current economic situation of key market players is hindering a faster recovery?

In any case, the market share of promotable business travel is rising significantly, reaching 60 per cent among European business travellers in 2022, and 67 per cent among those from overseas. IPK International’s survey of travel intentions confirms this trend, with 43 per cent of respondents planning a traditional business trip in 2023, and 77 per cent a MICE trip (multiple answers permitted).

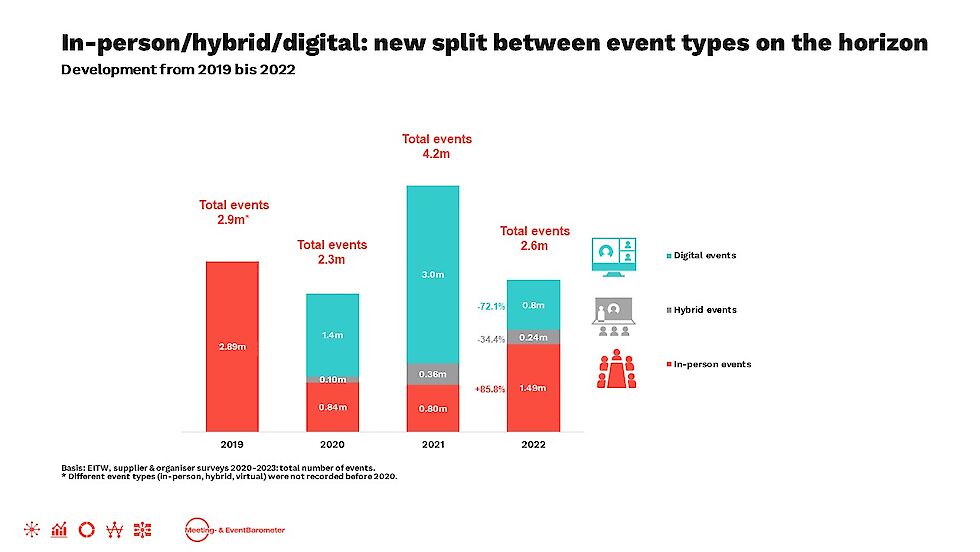

A fundamental shift in profiles is also evident within the promotable business travel segment. The 2.9 million events recorded by MEBa in 2019 are the starting point.

The initial reaction to the lockdown in 2020 was to replace almost half of the previous year’s in-person events with virtual formats, with the number of in-person events seeing a significant drop to 0.8 million. For the first time, hybrid events (100,000) appeared as an additional segment combining online and in-person formats.

This development picked up pace in the second year of the pandemic, with virtual-only events increasing more than twofold on 2020 to 3.0 million. There was a sharp rise in hybrid events to 360,000, while the number of in-person events fell further due to the long lockdown at the start of the year. In total, there were more events in the second year of coronavirus than the record number in 2019, and that is also reflected in the attendance figures. So has the digital boost from coronavirus led to an expansion of the market overall?

An analysis of the MEBa findings in 2022 reveals a rise in offline events. Robust growth in in-person events offset the decline in hybrid formats, while virtual-only events experienced a sizeable drop.

A comparison of 2019 and 2022 shows that new formats have not only emerged but also become established. However, it remains to be seen how important they will be in the post-pandemic era.

The return of in-person events is a clear indicator that face-to-face meetings will continue to be in demand in the future. The figures highlight the need for a focus on both in-person meetings and virtual networking, a fact confirmed by how the organisers surveyed see the market developing over the coming years. If providers want to compete in this mix of formats, they will need the right soft skills for in-person events, including a high quality of service and attractive supporting programmes, as well as the digital expertise to organise virtual and hybrid formats.

Targeted research, conducted by bodies such as the Future Meeting Space network founded in 2015 by the GCB and the Fraunhofer Institute for Industrial Engineering, will provide the basis for innovative communication formats. These will be key to Germany maintaining and expanding its leading position in the international business travel market.

4. The business travel market is a driver of the sustainability strategy

Our strategic approach to permanently and substantially reducing inbound tourism’s environmental footprint is based on the principle of ‘measure, reduce, offset’. This applies to the same or even greater extent to business trips to Germany, as these often involve longer journeys (see above – an above-average proportion of business travel to Germany originates overseas).

The first step, measure, requires the emissions generated by events to be analysed as precisely as possible. Knowing exactly what an event’s environmental footprint is gives organisers, planners and providers invaluable information when deciding which format constitutes the most responsible choice. Guidelines such as the GNTB’s balance score card and the integration of data into performance monitoring are important steps towards optimising processes from an environmental perspective.

Transport offers further opportunities for reducing emissions along the customer journey and is a key factor when deciding between in-person, hybrid and virtual events. The concept of sustainable transport requires event venues to be accessible via bus, coach and rail, for example, and local public transport to be integrated into the event planning. There is also potential for private-sector investment in research and development to deliver better outcomes in terms of emissions, with the aviation sector among those looking to reduce their environmental footprint. Examples include technological advances such as greener engines and drive systems, and sustainable aviation fuels. This plays to Germany’s strengths as both a research and development hub and a well-established MICE destination.

While the strategic approach of ‘measure and reduce’ is effective at cutting emissions, it cannot reduce them to zero. Alongside technological innovations and targeted process design, offsetting models are a useful means of improving the environmental footprint of events, and they are easy to implement in business travel as companies are increasingly led by ESG criteria.

We can tell from demand and the supplier side that sustainability has ‘arrived’ as a factor in the MICE segment, and goes hand in hand with the shifting values of travellers.

Data analysis by IPK and teralytics shows a growing market share for rail journeys in the modal split. And the Quality Monitor survey of the German tourism industry for the period from May 2015 to October 2022 reveals that business travellers are more likely to take the train (13 per cent) than holidaymakers (11 per cent).

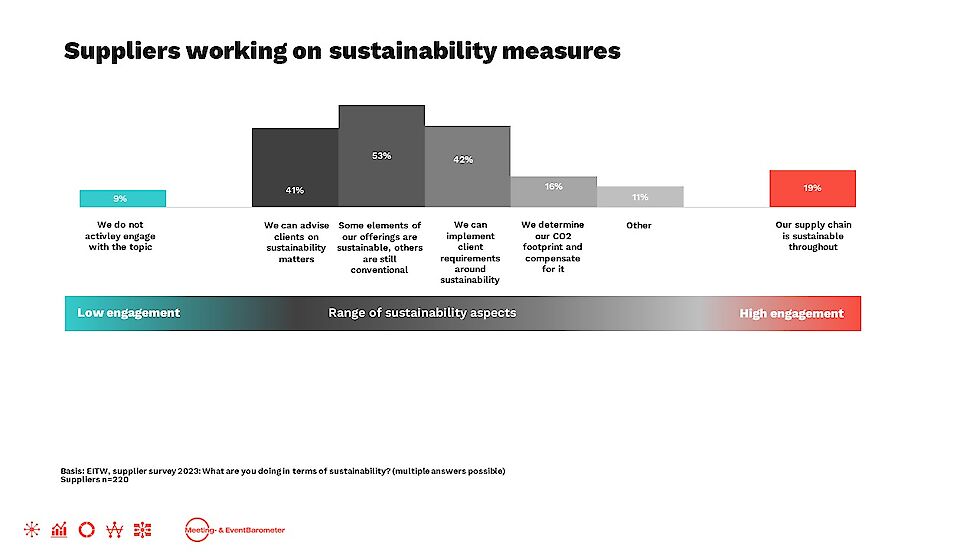

According to the 2022/2023 MEBa, sustainability is an increasingly relevant topic for providers in the events market. Around a fifth of respondents already consider themselves to be well-positioned – in terms of sustainability – across the supply chain, and the vast majority are able to meet various sustainability goals. Fewer than 10 per cent are not actively engaged with the topic at all. With an average of 7.1 per cent, sustainable events management is rather important to organisers.

This in turn is supported by the trend in demand. According to the respondents, sustainability has a growing influence on their business decisions, and thus on event planning as a whole.

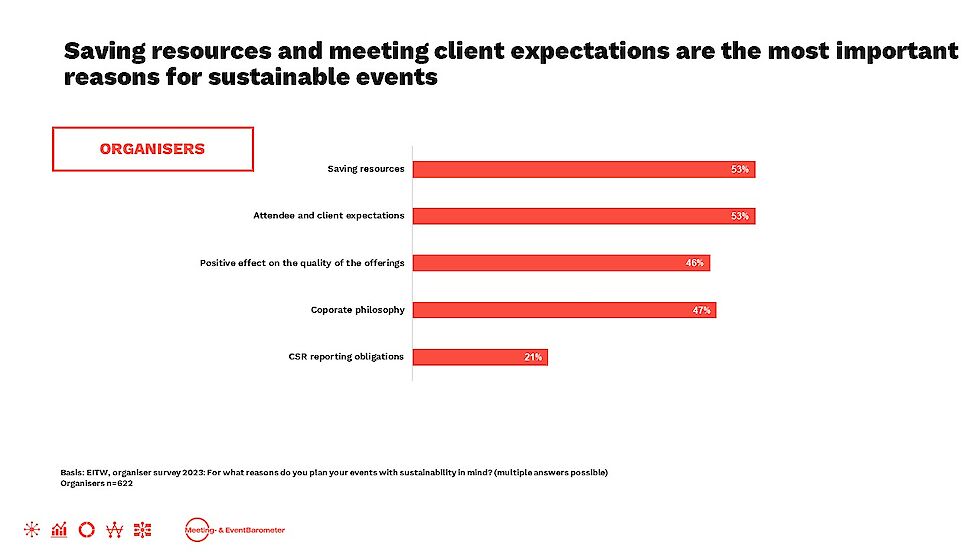

Event planning with a focus on sustainability is considered important across the board, with 53 per cent of respondents stating that the aim is to conserve resources, while the same number say that their customers expect it. Awareness of this topic is even higher in some key markets. In the UK, for example, 60 per cent of events organisers take sustainability into account in their event planning due to the need to conserve resources, while 55 per cent of organisers in the US stated that their customers expect sustainability to be a consideration.

5. Digitalisation – opportunities and challenges for the business travel market of the future

Digitalisation is a key element of the business travel market of the future. Almost two-thirds of respondents in the 2022/2023 MEBa agree with the statement that more and more business events will be virtual in the future. And just under two-thirds believe that planning will be mostly for hybrid formats. Respondents expect the number of in-person events to increase sharply in 2023, before levelling off the year after. However, the number of virtual-only and, in particular, hybrid formats is expected to continue rising in 2024.

Digitalisation presents many opportunities to increase the reach of events and so include those who are unable or unwilling to attend in person for a variety of reasons. While there may be no substitute for face-to-face meetings in an authentic setting, especially when it comes to providing inspiration, digital experiences can make far-away participants feel included and, with the help of immersive media and smart digital delegate journeys, even create a kind of fear of missing out.

Digital technologies add new dimensions to presentations, and the metaverse promises even more. AI-assisted applications can, in real time, link knowledge that has been amassed in the virtual sphere to the real-world level of the event.

And, last but not least, digitalisation and the shift to a greener economy are already closely interlinked and are opening up new opportunities for more sustainable business travel.

6. Changes in the way we work are driving the restructuring of the market

Digitalisation has brought fundamental changes to many aspects of how we work. The ability, for a lot of people, to complete the bulk of their day-to-day tasks online with the help of electronic devices has obviated the need for many employers or employees to be physically present in a specific location. It enables people to work from any location and collaborate across vast distances. BCD Travel estimates that around 36 million digital nomads were travelling the world in 2021 – and that figure is rising rapidly. On average, these extreme remote workers live for three to six months in a location they find particularly attractive. Reasons for choosing a specific location include a low cost of living, a longing for a certain lifestyle, and local culture and leisure options. But this desired work-life balance can only work if the right infrastructure, from internet access to co-working spaces, is in place.

The other side of the coin is that digital nomads miss out on the social element of being physically present in the workplace. This increases the importance of team building events, for example, and of adaptable meeting structures for agile working in flexible teams.

Business events are a key tool for coming up with new approaches in areas of complexity. People who meet in a professional context are able to share knowledge and create networks, thus delivering the platforms on which the answers to the major questions of our time are formulated. The recent ‘Redefining event attendance’ report by Future Meeting Space highlights how important in-person events are as a source of inspiration and a means of attracting and retaining staff. For example, 82 per cent of the respondents surveyed in the report state that in-person events give them new ideas. In an era of multiple global challenges, business events can support the necessary transformation processes and provide a stage for constructive dialogue on many levels and in many formats. Their value as venues that facilitate social interaction and build trust will also increase in the face of new, more individualised working environments. And 91 per cent of respondents state that they visit events to network.

Furthermore, conferences, training courses and meetings are now increasingly being bundled into a single trip, rather than being attended separately, thus ensuring greater sustainability. More time is taken over the decision to travel, whether for business or pleasure, and trips are tending to be longer and have more packed into them. The term ‘blurred travel’, for example, covers various ways of combining work and leisure, such as staycation (leisure activities in your country or local area), bleisure (extending a business trip for personal purposes) and workation (travel to attractive destinations with the aim of working from there too).

Any future offerings on the events market will have to take this fundamental change – this new world of work – into account. The ability to plan in-person events so that they can be adapted to the participants’ expectations will be a decisive factor. According to the findings of the aforementioned ‘Redefining event attendance’ report, this includes transport at the venue (‘micromobility’, e.g. scooters, e-bikes), the provision of work spaces and the integration of the local area into the event itself.

©

© ©

© ©

© ©

©