German business event market in transition

© Ambitious creative co rick barrett / unsplash.com

© Ambitious creative co rick barrett / unsplash.com

COVID-19 has presented public life and almost all industries in Germany with a new set of challenges and opportunities. Consequently, the legitimate question arises: What is the way forward? The latest Meeting & Event Barometer has addressed this question.

2019 was another record year for the German meetings and conventions market - according to the latest Meetings & Events Barometer, around 423 million people attended meetings, conventions and events in Germany. The number of international guests also skyrocketed, with a growth of 15.9 percent compared to the previous year. Therefore, expectations for 2020 were high. But then COVID-19 emerged and paralyzed public life and almost all branches of the economy. In addition to the exceptional global health situation, the novel virus also caused the well-known restrictions in public life. These hit the MICE industry particularly hard: Countless event cancellations and postponements, declining participant numbers and losses in revenue were the results. Many players in the event market are faced with the question: What is the way forward?

The answer is more complex than the question may suggest because the virus has remained omnipresent so far, many restrictions are still in place and it is simply impossible to reliably predict further developments. Here and there, however, one can see first glimmers of hope: the number of new infections has been stabilized at a low level in many parts of the world, and the first loosening of restrictions has been announced – just like in Germany, where the states are slowly restarting public life and events. Therefore, all federal states are currently dealing with the federal government’s ban on major events until August 31st 2020 and are finding their own regulations and definitions for the events sector. It has once again become clear that the situation, which continues to develop dynamically, makes it difficult to make a reliable forecast. In order to create a solid data basis on the effects of the corona pandemic and to be able to make future decisions accordingly, the GCB together with the EVVC has commissioned the European Institute for the Meetings Industry (EITW) to analyze the events market and develop scenarios for the market’s recovery.

Market recovery at the end of the year at the earliest

The study shows that more than half of all events planned for 2020 had already been cancelled prior to the study’s data collection deadline of March 30th. On top of that, one third of all events were postponed with the hope of improvement. The study also highlighted that planners of larger events were more likely to put their hopes on postponing their events. Smaller events, on the other hand, were cancelled more quickly or have been moved to the virtual room without further ado. Across all types of event locations, this has resulted in a predicted average revenue loss in the six-digit range per company in the first quarter of 2020. Consequently, this leads to the endangerment of every third job in the event industry.

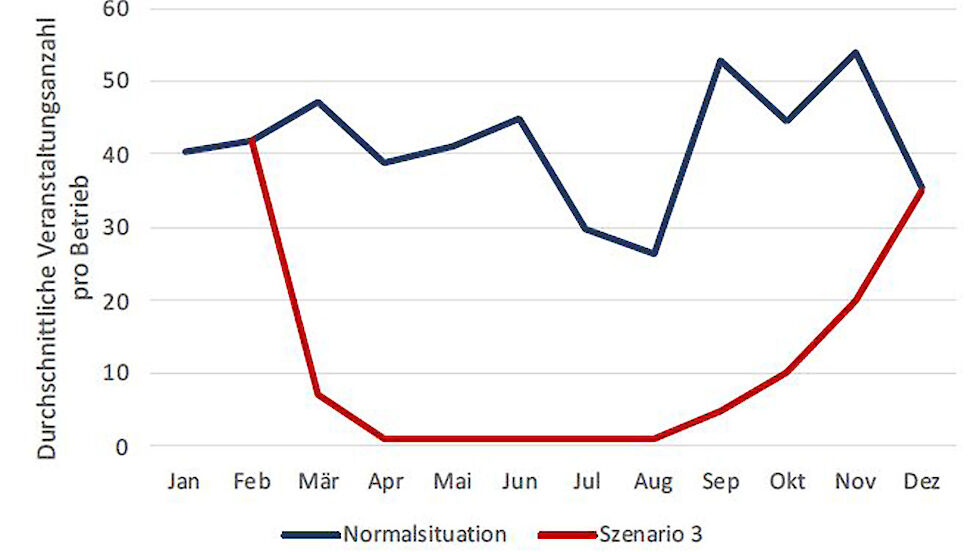

In order to better assess future developments, the EITW developed two alternative scenarios based on the current information. The first scenario assumes that the corona pandemic will peak between the months of June and August and predicts the industry’s restart in September. Even still, this positive scenario means that only around one third of all originally planned events would be taking place this year. Smaller events could experience a full recovery by the end of the year. Medium-sized and larger events, on the other hand, should not expect a normalization until February or April/May next year.

© EITW

© EITW

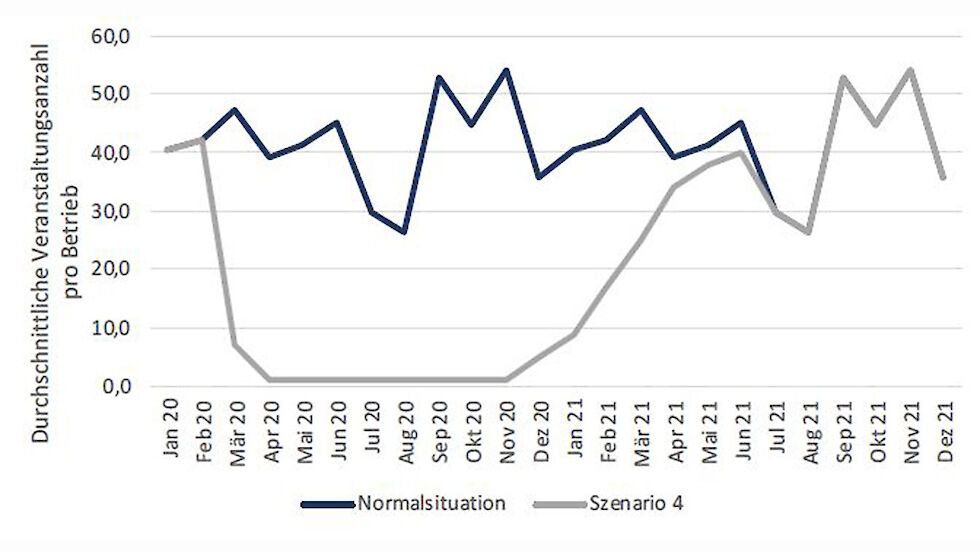

The second, and less optimistic, scenario assumes the industry’s re-launch in December 2020. This would entail a cancellation of 90 percent of all planned events. However, the market is unlikely to fully recover before the summer of 2021. In this scenario smaller events could once again hope for a faster normalization than the larger events. A full recovery is not likely prior to next year’s autumn.

© EITW

© EITW

Digital event formats continue to gain traction

Regardless of these two scenarios, the study also forecasts fundamental and far-reaching changes within the German meetings and events market. Above all, the establishment of digital formats will continue to gain traction. Before the crisis only 47 percent of all respondents saw future potential in virtual events. Shortly after, this figure had already risen to 75 percent. The future role of hybrid events has also been reassessed during the crisis: Whilst only one third of all respondents believed in their potential prior the crisis, the number had already risen to 60 percent by March 9th.

Reliable statements regarding the further development of the pandemic and corresponding easing of the situation are not possible at the moment. Nevertheless, the study with its scenarios and forecasts offers clues which must be carefully compared with the actual developments. This places the responsibility upon each and every one of us to continuously monitor our new processes and standards.

©

© ©

© ©

© ©

©